how much taxes does illinois take out of paycheck

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Illinois Hourly Paycheck Calculator.

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Amount taken out of an average biweekly paycheck.

. Payroll taxes in Illinois. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Personal Income Tax in Illinois.

Illinois tax year starts from july 01 the year before to june 30 the current year. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Newly registered businesses must register with IDES within.

You can even use historical tax years to figure out your total salary. There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of their income tax filing. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator.

Total income taxes paid. The Illinois Paycheck Calculator uses Illinois tax tables and Federal Income Tax Rates for 2022. For those who make between 10000 and 20000 the average total tax rate is 04 percent.

As of January 1 2022 the Illinois unemployment tax rate ranges from 0725 to 7625. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124. How Much Federal Tax Is Taken Out Of My Paycheck In Illinois.

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding. So the tax year 2022 will start from July 01 2021 to June 30 2022. Personal income tax in Illinois is a flat 495 for 20221.

The wage base is 12960 for 2022 and rates range from 0725 to 7625. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Personal income tax and unemployment tax.

Just enter the wages tax withholdings and other information required. What percentage is taken out of paycheck taxes. The average tax rate for taxpayers who earn over 1000000 is 331 percent.

These are contributions that you make before any taxes are withheld from your paycheck. If youre a new employer your rate is 353. Personal income tax in Illinois is a flat.

Amount taken out of an average biweekly. Rates are based on several factors including your industry and the amount of previous benefits paid. After a few seconds you will be provided with a full breakdown of the.

There are two state taxes to be aware of in Illinois. How much is 75k after taxes in. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

Paycheck Taxes Federal State Local Withholding H R Block

Vote Yes For Fairness This Is How Opponents Of The Fair Tax Think Of Hardworking Illinoisans Billionaires Like Liz Uihlein Don T Care About Our Middle And Lower Income Families They Only

Illinois Paycheck Calculator 2022 2023

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live

Illinois Paycheck Calculator Smartasset

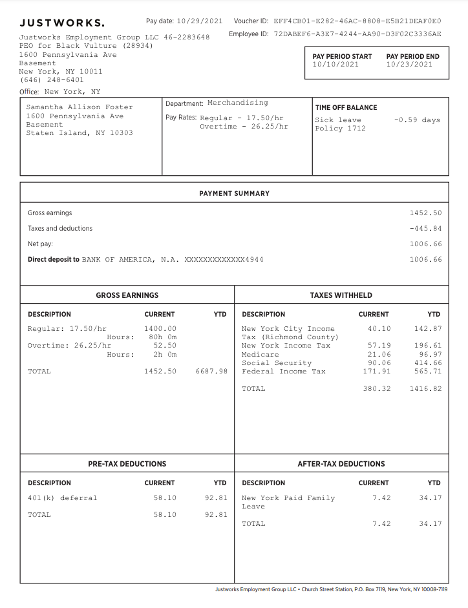

Questions About My Paycheck Justworks Help Center

Free Online Paycheck Calculator Calculate Take Home Pay 2022

State Withholding Form H R Block

Illinois Hourly Paycheck Calculator Gusto

How Many Tax Allowances Should I Claim Community Tax

Illinois Paycheck Calculator Adp

Illinois Payroll Services And Regulations Gusto Resources

Taxes 5 1 Taxes And Your Paycheck Payroll Taxes Based On Earnings Paid To Government By You And Employer Income Taxes You Pay On Income You Receive Ppt Download

Referenda Archives Taxpayers United Of America

2022 Federal State Payroll Tax Rates For Employers

Paycheck Tax Withholding Calculator For W 4 Tax Planning

What Taxes Are Taken Out Of A Paycheck In Illinois