cash app card overdraft fee

Dave offers small cash advances up to around 75 Wilk says to cover what could have been an overdraft. Consumers pay 1 a month for the app.

Steps For Overdrawing My Cash App Account In 2022

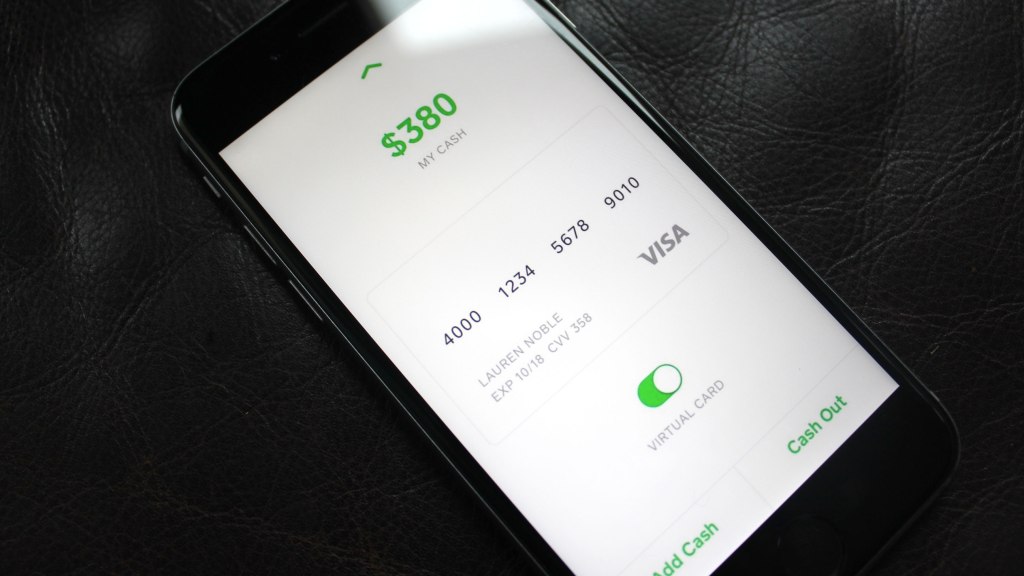

You can use your Cash Card to get cashback at checkout and withdraw cash from ATMs up to the following limits.

. Sending money using your credit card as funding source incurs a 3 fee which is paid by you You pay 1 if you request an instant withdrawal So for the most part Square Cash is free to use but Square Cash will pass credit card merchant charges on to you if you send money with your credit card as funding source. By using Cash App you agree to be bound by these Terms and all other terms and policies applicable to each. Cash App also charges a fee of 2 for ATM withdrawals.

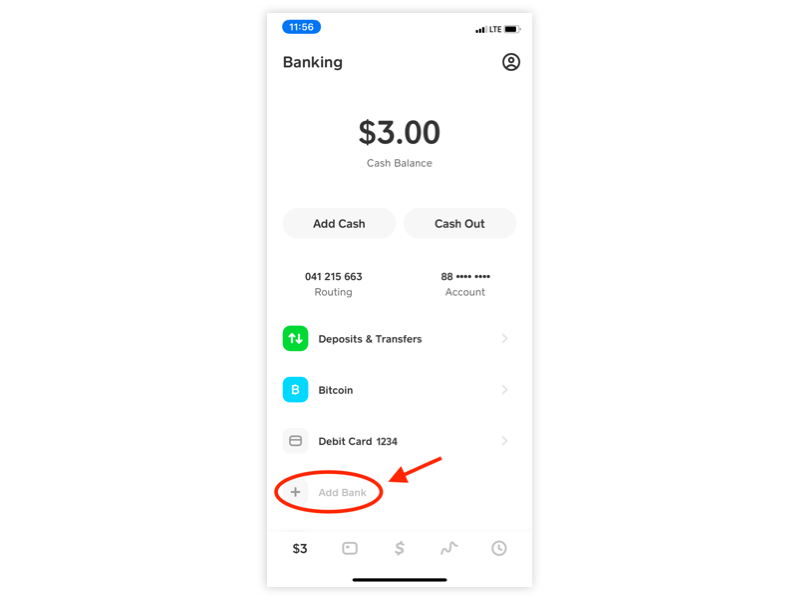

Cash App doesnt charge fees if you use your card at an ATM but other ATM charges will apply. It is possible to overdraft in several instances with Cash App. Some fees like ATM charges will be reimbursed up to 3 times per month and up to 7 per withdrawal if you receive at least 300 in direct.

This service fee may be a standard feature at most stores that are able and willing to make the deposit. Why financing is cheaper than paying cash here and now. If another overdraft charge comes within 10 months the fee will be increased to 3850.

Plus ATM withdrawals are free when you have at least 300 coming in each month. Cash Card is the customizable fee-free debit card. Cash app can not overdraft if the expense is greater than your balance it declines.

Bank of America charges a 35 overdraft fee per transaction. Stored balances of Cash Card customers are eligible for FDIC insurance through our partner bank. If the account does not have another overdraft charge for 10 months and then experiences an overdraft the fee will have reset to 33 per transaction.

However in the event that you need emergency cash from an ATM and must overdraft you may avoid a fee by depositing the money before the end of the same business day. I have no 211 resources anywhere near my area. 310 per transaction 1000 per 24-hour period 1000 per 7-day period To use your Cash Card to get cashback select debit at checkout and enter your PIN.

These funds are insured up to 250000 by the FDIC if our partner bank that holds your funds fails and specific deposit insurance requirements are met. No minimum balance or hidden fees. But if you set up a direct deposit and receive more than 300 per month in your Cash App balance then youll be reimbursed for three ATM withdrawals over a 31 day period.

Fee-Free Overdraft up to 100 with Overdrive. Wells Fargo charges a 35 overdraft fee per transaction. This includes every time a check or scheduled payment attempts to go through.

40000 fee-free Allpoint ATMs in the US. A single overdraft fee can take between 15 and 25 from your account. 21 rows Card purchase.

How much can you overdraft Cash App card. Moreover the limit for the cash out is set at 1000 per dayand 310 per transaction in one day. Even better is that for every subsequent 300 deposited in your account youll be reimbursed for another 31 days.

Use it everywhere to earn instant discounts on everyday spending. Buying my first car. So sending someone 100 will actually cost you 103.

Dave pays itself back as soon as the checking account has enough money in it. Although theres still no way of directly depositing money to Cash App and Card via ATM we showed you that there are other ways of depositing money to your Cash App. You must repay the loan in four weeks and pay a flat interest rate of 5.

I have 109 on my card and laid off right now. CashApp 1 Posted by 2 years ago Is it possible to overdraft a CashApp account 105. Download Cash App Speed up your direct deposits With a Cash App account you can receive paychecks up to 2 days early.

Fees vary across each financial institution though the average overdraft fee is 3358 up. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. Combine credit card cash back with other cash back offer.

Cash App charges a 3 fee when paying by credit card and a 15 fee for instant transfers. Can credit card debt be negotiated. You can use any ATM nationwide to withdraw cash from your Cash App account.

I feel like my bf is feeding me some bull but I want to get others opinion before I go off. Hotel double charges overdraft and bank interest. For the first two overdraft charges that occur on the account the fee will be 33.

Walmart uses its Rapid Reload system for cash deposits onto debit cards and the deposit may incur a 3-4 service fee. Cash app debit card. 1 Download Cash App.

I gave my 400 so he could settle a 360 fine. You can use the card to make ATM withdrawals up to a limit of 250 per transaction and per 24 hour period. Right now per-transaction fees are 350the fee the firm pays the bankand Dave asks only for a donation in the form.

Cash App provides loans ranging from 20 to 200. If you are sending money via a credit card linked to your Cash App a 3 fee will be added to the total. The weekly withdrawal limit is 1000 per week and you cant withdraw more than 1250 per month via ATM.

List of All Fees for Cash App Stored Balance We currently do not offer overdraft or credit features. Cashback transactions will count towards your ATM limits. Overdraft fees that are covered by the arrival of a sufficient direct deposit before 900 am on the following banking day will be dropped or reversed.

Most ATMs will charge an additional fee for using a card that belongs to a different bank. Cash Cards work at any ATM with just a 2 fee charged by Cash App. You will have to proceed to a cashier and inform them of your intention to deposit cash onto your Cash App card.

First Of All Which ATMs Can You Use For Withdrawal. Cash App ATM withdrawals would cost you 2 fee unless you make 300 deposit in your account every month. Now he is saying he gave his dad the 360 lent the card to a friend and is negative 105.

The more appropriate question would be how much you can borrow from Cash APP. 0 will be charged for transactions that are returned not paid due to NSF non-sufficient funds. Once you have received qualifying direct deposits totaling 300 or more Cash App will reimburse fees for 3 ATM withdrawals per 31 days and up to 7 in fees per withdrawal.

Prepaid cards with overdraft protection allow you to complete transactions that overdraw your account by as much as 10 with no penalty or fee as long as you restore sufficient funds in your account soon after the overdraft.

Activate Cash App Card Now 5 Easy Steps Activation Guide Helpline

How Can A Cash App User Order A Cash App Card Get Detailed Information

2022 Can I Overdraft My Cash App Card At Atm Gas Station Unitopten

Can You Overdraft Cash App And How Much Would That Cost You

Square S Cash App Now Supports Direct Deposits For Your Paycheck Techcrunch

Can You Overdraft Cash App Card How To Fix Overdraft Cash App Card

How To Add Physical Cash To Cash App Complete 2022 Guide Atimeforcash Net

Learn How To Activate Cash App Card In Simple Steps

Can You Overdraft Cash App All You Need To Know

All You Know About The Important Steps For Unlock Cash App Account In 2022 App Accounting Money Transfer

Can Cash App Balance Go Overdraft Negative Youtube

Cashapp Borrow 200 Loan Instant Approval How To Get A Loan From Cashapp Youtube Credit Card App App The Borrowers

How To Link Your Lili Account To Cash App

5 Ways To Put Money On Cash App Card Quick Guide

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

How To Contact Cash App Issues Resolved Customer Care Cash Card App Cash

Cash App Balance How To Check Cash Card Balance And Add Money Cash App

Learn About Cash App Overdraft Limit L Fix Cash App Negative Balance Cash App

How Can A Cash App User Order A Cash App Card Get Detailed Information